Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.

Episode 10: Improve your QOL through real estate management!I would like to send you the contents.

This time's theme is"Cash Flow Tree" (Part 1)

For those who are currently involved in real estate management or those who are considering it in the future,

This is a very important calculation of income and expenditure for everyone.

When CPM performs income and expenditure analysis and investment analysis of income properties,

We will use this "cash flow tree".

It may seem difficult because it is a list of alphabets.

However, the bottom line is that it is the "income and expenditure" of real estate management.

However, the point is that we try to reflect the actual situation as much as possible and look at it from an owner-like perspective.

It is completely different from the general real estate income and expenditure.

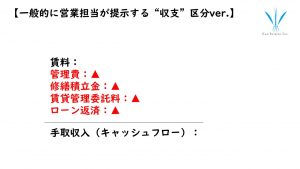

So, what kind of income and expenditure do you get from a typical real estate sales person?

For ease of understanding, the example is divided into categories.

After subtracting management fees, repair reserves, rental management fees, and loan repayments from the rent,

What is left over is often referred to as ``cash flow.''

Do you all know where the hole is?

Now, let's take this from the owner's perspective.

Let's try to reassemble it to reflect as much as possible what could actually happen.

...This is the "cash flow tree".

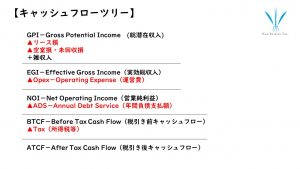

■GPI (gross potential income)

It refers to the expected total income if the property is fully occupied.

This is slightly different from the commonly referred to ``assumed rent for full occupancy''.

Even if the room currently has a tenant, it is not the current rent,

This is the estimated total income after upward and downward revisions have been made in consideration of market trends, etc.

Because it contains the word potential,

In some cases, you may not be able to reach your full potential.

There are cases where the rent is more than potential.

It might be good for you to remember.

You can think of it as something that has been adjusted to match your original potential.

However, in the rent roll at the time of purchase, from the time of new construction

There is a tenant who has lived there for a long time, and the difference in rent compared to other rooms is very harsh.

As soon as that room is vacated, the entire expected income system will go awry.

Therefore, the idea is to look at the property in terms of ``potential,'' which means if the property is fully occupied for a year at the market rent.

And subtracting from GPI is

These are lease losses, vacancy losses, and uncollected losses.

▲Lease loss

This means that the actual rent paid against GPI is

How negative was it? That's what it means.

This is the difference between the market rent read on GPI and the actual rent.

The reason why delamination occurs is not only due to location.

Indoor facilities, age, exterior appearance, recruitment period, etc.

There are quite a few factors that lead to a separation from the market.

It's an obvious story. I'll pull this out properly as well.

Or, for future predictions, read up to minus 10% of GPI.

It may be a good idea to set up your own calculation rules like this.

▲Vacancy loss/uncollected loss

This is what I read already.

In the cash flow tree, vacancy losses are naturally subtracted.

If you ask me, "There are years when there are no vacancies, right?"

There are some years when I come and go frequently.

As long as you are looking at the actual income and expenditure, read the bad case rather than the better case.

You should think of it as functioning as a simulation for the first time.

In this case, the ``vacancy rate'' should be calculated by taking into account the ``operating vacancy rate'' in that area.

Regarding the operating vacancy rate, how many days out of 365 days a year are there vacant rooms?

That's a percentage.

Now, where can I find out? That's the story.

If the management company is primarily local, it should theoretically be possible to calculate the occupancy rate.

By the way, it is said to be around 4-5% of residential properties in Tokyo.

In addition, in major cities nationwide, IREM is

We will announce the results of the survey once, so

I often refer to it.

By the way, vacancy loss also includes free rent periods.

and unrecovered losses. As you can see, this refers to losses due to delinquent payments.

In terms of current events, in response to rent reductions for several months due to the coronavirus pandemic,

If there was no compensation during that period and lost profits occurred,

This will be included in the uncollected loss.

●Miscellaneous income

Next, add income other than rent here.

For example, this includes income from vending machines on the premises of the property and income from antenna base stations on the roof.

What has been calculated so far is

●EGI (effective gross income)

is not it. This is cash flow before operating expenses and repayments.

On the contrary, this is a story within the category of "income".

Now, let's subtract the expenses (expenses).

Operating real estate inevitably requires expenses.

Personally, I think that unlike stocks and other investment products,

I believe this is the reason why it is called "real estate management."

Just holding it can make you run, in other words, depending on your ingenuity and effort,

It may also be possible to reduce expenses and improve cash flow.

That's why "management sense" is so important.

Yes, let's get to EGI (effective gross income).

The next thing to deduct is the “expenses”.

●Opex (operating expenses)is not it.

What comes to mind when you think of real estate operating expenses?

Building management fees and rental management fees paid to the management company. If it is a classified condominium, it is a repair reserve fund.

Fixed asset tax, water and heating costs, legal inspection costs, daily cleaning costs,

If you move out, there will of course be costs for restoration work and renovations.

Advertising fees (AD) and brokerage fees incurred when renting are also included in Opex.

If you look at it this way,

Real estate operations are expensive to maintain.

Subtract Opex (operating expenses) from the income category,

What comes out is quite important

●NOI (net operating income)

It becomes.

NOI represents the earning power of a property.

This NOI is often used when analyzing real estate investment, so

Please remember this!

Continue reading in the next part!

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.