Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.

Episode 12: Boost your quality of life with real estate management!I would like to send you the contents.

The theme this time is"Various expenses related to real estate transactions"is.

This is a very basic thing, but it always applies when buying and selling real estate.

Since this is a matter of expenses, let's check it again!

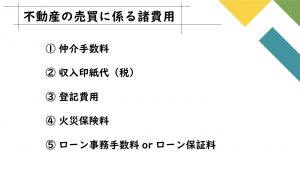

When buying and selling real estate, there are "miscellaneous expenses" that are incurred in addition to the purchase price.

These are collectively referred to as miscellaneous expenses, but they can be roughly broken down as follows:

・Intermediary fee

This is paid as a success fee when the transaction is an "intermediation" or "mediation" transaction, so

There is no charge in the case of a direct transaction between the seller and the buyer.

Regarding brokerage fees,This videocheck!

・Revenue stamp fee (tax)

When this is affixed to a sales contract, the amount of stamp duty will vary depending on the purchase price.

The list of taxes is as follows:

When attaching this to a sales contract, it is customary for the costs to be split equally between the seller and the buyer.

In addition to the sales contract, if the buyer uses a loan to purchase the property,

It must also be affixed to the loan agreement (loan contract) with the financial institution.

In some cases, the buyer prepares the stamp himself, while in other cases, the financial institution prepares it.

In some cases, stamp duty is deducted at the time of loan settlement.

The stamp fee to be affixed to the loan agreement also varies depending on the loan amount, so

Please refer to the list above.

・Registration fees

These are literally the costs associated with registering the real estate being bought and sold, and are usually entrusted to a notary public.

In short, it is called "registration fee", but strictly speaking, it is "registration license tax".

"Cost of obtaining registration information," "fees for judicial scriveners," "travel expenses, business trip expenses, and postage costs," etc.

Collectively, these are known as "registration fees."

At first glance, you might think that registration fees are the same as the judicial scrivener's fee, but

Most of this is a tax called "registration tax."

The registration tax that is normally paid by the buyer to the government is held by a judicial scrivener and paid on the buyer's behalf.

In addition, the buyer will need to register the transfer of ownership, and if purchasing with a loan,

In addition, registration fees will be required to attach a mortgage to a financial institution.

On the other hand, if the seller purchased the property with a loan, the mortgage is still attached.

In order to remove it, a procedure for cancelling the mortgage will be required.

・Fire insurance premiums

If you are purchasing with a loan, this is a must as it is a condition of the loan.

There is no obligation to join if you purchase with cash.

In the case of purchasing an old house that is not fireproof, the price may be higher, so

Get a quote in advance for each type of coverage.

・Loan administration fee (or loan guarantee fee)

This is self-explanatory, but the difference between a home loan and a loan to purchase income-generating real estate is,

The nature of payments made to financial institutions and non-banks is different.

When purchasing income-generating real estate, this fee is often paid as a loan administration fee.

On the other hand, if you take out a mortgage for a home you live in, the debt is owed to a guarantor company within the group.

You will have to pay a fee for the guarantee to be provided.

The guarantee fee may be paid in a lump sum at the beginning, or it may be passed on to the interest rate instead of being paid at the beginning.

It doesn't necessarily have to be included in the costs.

In terms of the amount, some places offer a flat rate, while others offer a percentage of the loan amount.

In some places the fee is set at a rate.

Loan administration fees and loan guarantee fees are somewhat different in nature,

They were grouped together as payments made to financial institutions.

Yes, so far I have listed the breakdown of various costs involved in purchasing real estate.

When you look at it again, you realize that real estate involves quite a few costs other than the purchase price of the property itself.

By the way, apart from the things I have introduced, there are also other things such as the settlement of property taxes,

For an apartment building, this includes the settlement of management fees, repair reserve funds, and the cost of obtaining a certificate of conformity, etc.

It also depends on the property you purchase.

Regarding real estate acquisition tax, if you purchase a home that meets certain requirements,

It is tax-exempt, but it will definitely be levied in the case of income-generating properties.

The payment period varies depending on the municipality.

A tax notice will arrive some time after you obtain the certificate, so

Opinions are divided on whether to include it in the costs,

There is no doubt that it is an initial cost,

Personally, I recommend including this in your budget.

Especially in the case of real estate management,

The initial cost is the first thing that eats into your cash reserves, so

From the perspective of how long it will take to recoup the investment,

We recommend that you read through the costs involved.

Real estate is a product that generally has a lot of costs in addition to the price of the property, so

With this in mind, I hope you will be able to acquire a great property in a way that satisfies you!

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.