Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.

Episode 13: Improve your QOL through real estate management!I would like to send you the contents.

Here is the topic for this time.

"Tax on capital gains from real estate"is!

I'm sure there are some people who would like to hold on to their real estate without selling it.

There will always be an option to sell at some point.

Recently, especially with the rise in real estate prices, many people may be taking a short position.

What you should be aware of is the "transfer tax" that is imposed on the sale of real estate.

I think there are many people who somehow know that ``that kind of thing seems to cost.''

However, to be honest, when I talk to people, I find that there are surprisingly many misunderstandings about how the tax amount is calculated.

In the first place, for convenience, it is called "transfer tax".

There is not actually a tax item called "transfer tax",

Only for capital gains"income tax"and"Resident tax"This means that you will pay.

In other words, the sale generates income, which is then taxed.

I think it's easy to understand because up to this point it's the same feeling as regular income tax or resident tax.

However, there are many misunderstandings here.is "income = profit"It's about the way of thinking.

If you are purchasing with cash instead of using a loan at the time of initial purchase,

I think it's easy to understand that the amount of money you receive = income.

So what if you have a loan balance?

When I was talking with everyone, I found out that from the sale price, I would pay the various expenses associated with the sale, and then pay off the loan in full.

Many people seem to interpret the amount left here as "income = profit."

Certainly, both in reality and intuitively, it is better to think of the remaining amount as "income = profit" based on that way of thinking.

It makes sense, and in terms of actual value, it should feel like you're making more money.

but,There is actually a misunderstanding hereoftenThat's right.

Now, let's take a look at the actual formula for calculating transfer tax.

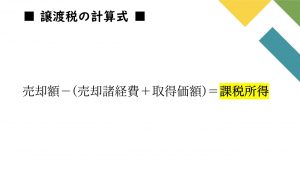

Sales amount - (sales expenses + acquisition price) = taxable income

This is the formula used for calculation.

The notation method may vary depending on the book or site, but

The point is``Subtract the cost of selling and the original purchase price from the amount sold.

The remaining amount is taxable income.”That's what I'm saying.

The taxable income obtained here is multiplied by the prescribed tax rate to determine the amount of tax to be paid.

So, here is where the misunderstanding lies."Acquisition cost"That's where it is.

Acquisition price = the amount originally purchased...

This is not the price when you bought it as is,

You must also take into account depreciation during the holding period of the property.

In the case of income-generating properties, annual depreciation is relatively easy to understand because a final tax return is filed.

The same idea applies when selling your home real estate.

In other words, this acquisition price is not the same as the amount at the time of purchase,

This means that it is the "book value". This is where the misunderstanding comes from.

This is difficult to understand by itself, so let's look at a simple calculation example.

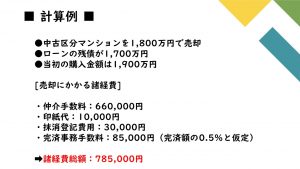

Example) Suppose you sell a used condominium for 18 million yen.

Assume that the remaining balance of the loan that must be paid off is 17 million yen.

Miscellaneous sales expenses include brokerage fees, stamp fees, cancellation registration fees, and administrative fees at the time of completion.

Let's say that the original purchase price for this property was 19 million yen.

The costs at the time of sale are as follows.

・Brokerage fee 660,000 yen

・Stamp fee 10,000 yen

・Deletion registration fee 30,000 yen

・Administrative fee upon full repayment: 85,000 yen (estimated to be 0.5% of the full repayment amount)

・Total miscellaneous expenses: 785,000 yen

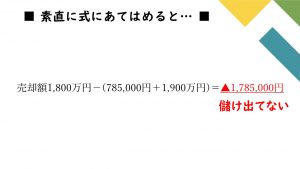

Sales amount 18 million yen - (785,000 yen + 19 million yen) = ▲1,785,000 yen

If you apply it to the formula, it will look like this, so you're not making any money! That's what it means.

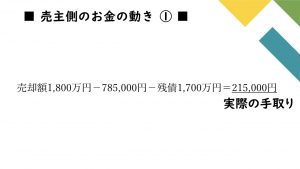

Furthermore, if we look at the actual cash of the seller,

18 million yen - 785,000 yen - Loan balance 17 million yen = 215,000 yen

I think that's the feeling.

Won't this 215,000 yen be taxed? and.

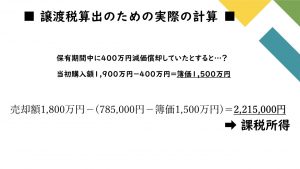

Now, let's actually calculate the transfer tax. Let's say that while you own this real estate,

Assume that you have lost 4 million yen in depreciation.

Taking this into account, we get

Sale price 18 million yen - (785,000 yen + book value 15 million yen) = 2,215,000 yen

It will be “treated” as if you are making a profit.

Taxable income is 2,215,000 yen, multiplied by the tax rate to get the transfer tax amount.

And one point for the tax rate!

When selling or transferring real estate, the tax rate differs depending on whether five years have passed since acquisition.

If the term is 5 years or less, the rate is 39.63% for a short-term transfer, and if the term is 5 years or more, the rate is 20.315% for a long-term transfer.

In fact, the tax rate varies by nearly double depending on the number of years of ownership. The key point is that it takes 5 years from the date of acquisition.

To be precise, this is not a five-year period based on delivery. What I mean is,

The real estate acquired in April 2016 was sold in June 2021.

Indeed, considering it on a delivery basis, it has been 5 years and 2 months, so

It will be a long-term transfer with a low tax rate, right? and.

However, exactly“As of January 1st, the year in which the property was sold,

Whether 5 years have passed since the acquisitionThat's the rule.

In other words, based on precedent, even if you sell it five years after acquisition,

As of January 1, 2021, five years have not yet passed, so short-term transfer applies.

This difference in touch can nearly double the tax rate.

This is another point that I feel many people misunderstand, so please keep this in mind.

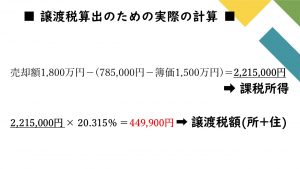

Now let's go back to the calculation example.

Sale price 18 million yen - (785,000 yen + book value 15 million yen) = 2,215,000 yen

Assuming that this is a long-term transfer, the taxable amount of 2,215,000 yen is multiplied by 20.315%, resulting in a tax amount of 449,900 yen.

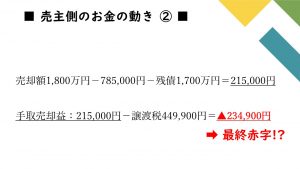

Next, if we apply it to the actual movement of money,

18 million yen - 785,000 yen - Loan balance 17 million yen = 215,000 yen - Transfer tax 449,900 yen → ▲ 234,900 yen

That's what it means.

I thought I could somehow pay off the remaining balance of the loan and close it out with a positive result,

After paying the transfer tax, the position will become negative and you will have to close it out.

According to this calculation, if there were more outstanding debts, it would be negative in the first place and there would be no income at all,

If you calculate the transfer, it is possible that you will end up paying taxes.

This is really important knowledge, but I get the impression that there are quite a few people who don't know about it.

Among the owners who are viewing this,

"I'll buy it!"

“There is a buyer who wants the property you own!”

I think you will receive some kind of direct mail or information from these companies.

I have rarely seen a company that solicits a sale without even reading up on the transfer tax.

If I say that, they won't sell it, so why don't you say it?

I don't know if the sales person doesn't know how to calculate capital gains and losses in the first place, but

This is a great opportunity to sell and take profits, so that you don't have to close out due to negative results.

I think you should be careful.

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.