Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.

Episode 22: Improve your QOL through real estate management!I would like to send you the contents.

The theme of this time's Conspi Channel is, "I intended to save taxes but went bankrupt with a surplus!? Let's understand the dead cross."

This time we will discuss “dead cross”!

If you are involved in real estate management, you have probably heard this word at least once.

I actually don't know much about it! Some people may say so.

Today I would like to explain this important word "dead cross".

So let's get started!

“It has a tax saving effect!”

If you have ever been told this by a sales representative for a one-room investment property,

I'm sure there are quite a few.

I'm not saying that everything in this talk is wrong...but,

Basically, if you are purchasing real estate for "tax saving purposes only",

That's a mistake, you're out.

What lurks behind this is a condition called a "dead cross."

First, let's look at the meaning of the word "dead cross".

What is a dead cross in real estate?

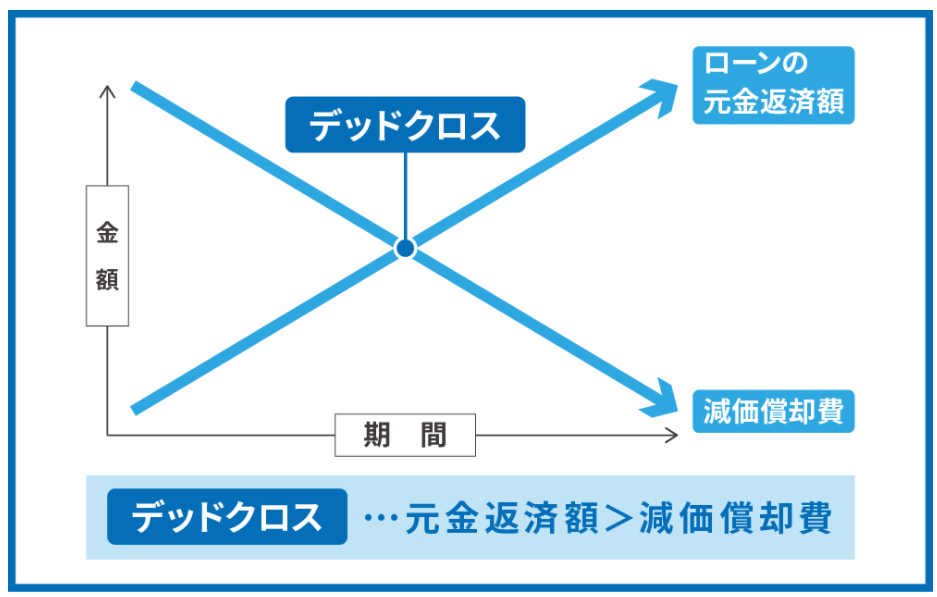

This refers to a situation in which the principal repayment amount of a loan exceeds the depreciation expense.

Even if only this definition is explained,

It's really hard to understand, isn't it?

To summarize very roughly,

“Even though we are operating with a negative balance every month,

You will end up with a surplus on your final tax return.”It can be rephrased as

In other words, even though there is no cash flow,

On the books, it was a profit,

This means that you will have to pay taxes.

"Eh? Does that happen?"

You might even hear someone saying,

If you have experience in compartmentalized ownership or one-room investment,

I'm sure you've experienced it before.

To understand this,

Fundamentally, the “actual account movements” in real estate management,

There is a difference between the movement on the books,

You need to keep that in mind.

The point is that

This is "depreciation expense."

Real estate buildings are

It is not expensed all at once at the time of acquisition,

Depending on the service life,

Expenses are recorded by dividing them into multiple years.

This is "depreciation expense."

Depreciation expense is

There are no actual expenses involved,

It is possible to record it as a bookkeeping expense,

This is the key to the so-called "tax saving effect."

By the way, the service life depends on the structure of the building.

It is like this.

Steel reinforced concrete construction: 47 years

Reinforced concrete construction: 47 years

Heavy steel construction: 34 years

Wooden construction: 22 years

Divide into this period,

Let's record the depreciated portion of the building as an expense every year.

It is that.

So, why does this cause a dead cross?

A building is divided into the "main body" and "equipment".

The equipment is depreciated over 15 years from the time of new construction.

Therefore, in a short period of 15 years,

Since we will record depreciable assets as expenses,

When you first acquire the property, you will be able to depreciate it significantly.

However, once you pass this point,

Depreciation expenses that can be recorded as expenses have decreased significantly,

This is how a surplus appears on the books.

In addition, in the case of used properties,

Since the age of the building is subtracted from the useful life mentioned above,

The period before a dead cross occurs will be shorter.

In addition to the decrease in depreciation expenses,

The factors that lead to dead crosses are:

・The interest portion of the loan that can be recorded as an expense will decrease.

This can also be mentioned.

In the case of real estate management,

Of the loan payments,

The principal portion is not considered an expense.

On the other hand, interest (borrowing interest) can be recorded as an expense,

This is also true regardless of whether the repayment method is the principal and interest equalization method or the principal and interest equalization method.

The amount that can be recorded decreases each year.

This is also one of the causes of "dead cross" occurrence.

In particular, in the case of compartmentalized ownership,

If you purchase with a loan,

I think there are very few cases where there is ample cash flow.

Therefore, in the first place, the income tax payment funds after achieving a surplus are

The idea of financing with cash flow

There are quite a few owners who don't have one.

Despite the monthly balance being in the red,

If it means paying taxes by making a profit,

This could lead to a situation close to what is known as ``bankruptcy in the black''.

However, dead cross

Beyond purchasing income-generating real estate with a loan,

The fact is that it is almost unavoidable.

The important thing is

・The tax saving effect will not continue forever.

・Ensure cash flow that exceeds the tax payment source when the business becomes profitable

This is my understanding.

As I mentioned at the beginning,

If you are purchasing real estate for the purpose of “tax saving only”,

That way of holding it is out.

However, over the past two to three years,

Only in cases where it is certain that the annual income will be abnormally high,

Take advantage of tax savings in the short term,

From then on, tax payments will be made within cash flow according to the surplus.

If your plan is to fully cover your expenses,

Personally, I think that's true.

From a salesperson who has completely lost all sense of logic in this area.

If you are prompted to say “It will save you tax!”,

You might want to be careful.

Learn about real estate management

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.