Thank you for visiting us.

This is conspi public relations.

This time, it was distributed on CONSPIRIT's official channel on YOUTUBE.Episode 50: Boost your quality of life with real estate management!I would like to send you the contents.

This time we'll be talking about vacancy rates.

You may be wondering why we should be talking about vacancy rates now, but there is actually a lot to consider about vacancy rates.

In fact, there are three types of vacancy rates depending on the measuring stick used.

What calculations do you generally make when calculating vacancy rate?

For example, let's say you own an apartment building with 10 units.

If there are currently two vacant rooms, the calculation formula would be:

2÷10×100=20%

The vacancy rate for this apartment building is 20%.

It's very easy.

This is what people commonly refer to as the "vacancy rate."

However, strictly speaking, this calculation results in the "current vacancy rate," one of the three types of vacancy rates.

1. Current vacancy rate

A point in time vacancy rate is a rate calculated by taking a snapshot of the vacancy rate at a certain point in time. It's like a snapshot.

It's a very simple way of calculating how many vacant units are currently available, using the total number of units in the target properties as the denominator.

When using this, you can find out how many rental properties are in the target area and how many of them are vacant,

It is useful in situations where you want to count how many vacant units are available at the end of the month using the total number of units managed by a management company as the denominator.

Another advantage is that it is easy to calculate, as relatively little information is required.

However, since it only measures vacancy at a certain point in time, it does not reflect the "time axis" that is important for real estate management, in other words, "how long the property has been vacant."

And the vacancy rate that takes into account the weak point of the "point in time vacancy rate," the "time axis," will be the next operating vacancy rate.

2. Occupancy rate

For example, let's say there is an apartment with 10 rooms.

Let's say that this property had two units move out during the year, and it took three months for new tenants to move in for each unit.

To calculate the "occupancy rate" for this property

(Number of rooms moved out per year x number of months vacant) ÷ (total number of units x 12 months) x 100

The calculation formula is as follows.

Let's apply the example numbers here:

(1 room x 3 months + 1 room x 3 months) ÷ (10 rooms x 12 months) x 100 = 5.0%

And then,

This means that there will be a vacancy loss of 5.0% per year.

The calculation period is arbitrary, but it is usually easier to understand if you measure over a one-year period.

This is more realistic for owners than the current vacancy rate, so I think it would be useful for formulating business plans, etc.

Now, the last one.

What is it that neither the "current vacancy rate" nor the "operating vacancy rate" fully reflects?

That's the difference in rent per room.

When calculating vacancy rate, each room is simply counted as one room.

However, what if there were actually two vacant rooms, one a one-room residence and the other a ground floor store/office type, with the rent being three times that of the residence?

Also, what if the rent for a one-room apartment drops...income is not constant in real estate management.

The vacancy rate cannot cover the difference in rent between rooms.

The metric used here is the rental vacancy rate.

3. Rent vacancy rate

Since it is calculated from the perspective of rent, the denominator is the "expected full occupancy rent," and in terms of CPM it is "GPI."

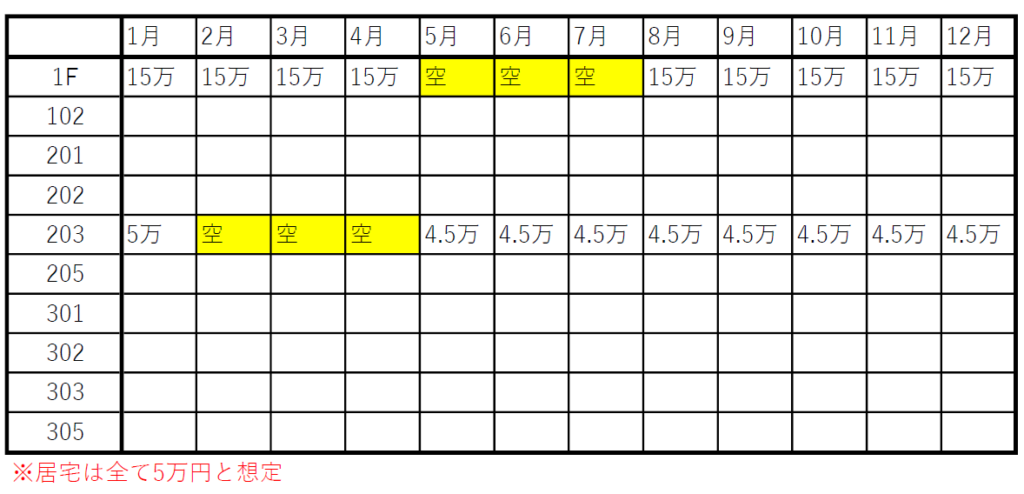

Now let's look at an example.

We will assume that the rent for all residential areas is 50,000 yen, and assume that unit 203 in the diagram was rented out for 45,000 yen after being vacant for three months.

In that case, the GPI for this property is:

Residential section: 50,000 yen x 9 rooms x 12 months = 5,400,000 yen

1F store/office: 150,000 yen x 1 room x 12 months = 1,800,000 yen

GPI = 7,200,000 yen

It becomes.

Next, calculate the vacancy loss and the loss due to rent decline.

(150,000 yen x 3 months) + (50,000 yen x 3 months) + (5,000 yen x 8 months) = 640,000 yen

therefore,

640,000 yen ÷ 7,200,000 yen × 100 = 8.89%

This is the rental vacancy rate.

We have now looked at three types of vacancy rates, but I hope you can see that from an owner's perspective, occupancy vacancy rate and rental vacancy rate are closer to the actual situation.

However, it is virtually impossible to gather all the information before purchasing.

You may just be able to confirm the vacancy rate by checking the rent, but if you have examined the property to this extent and are considering a purchase, the speed of your bid will probably slow down.

In that sense, the current vacancy rate, which is determined using limited primary information, is by no means inferior.

On the other hand, the rental vacancy rate is a very suitable figure to analyze as an overall summary of the annual occupancy of properties owned.

The important thing is to know how to calculate each and their advantages and disadvantages.

We hope you will take this opportunity to learn about these three types of vacancy rates.

Learn about real estate management

If you likeConspirit official channelPlease also take a look.

Please subscribe to the channel and give us a high rating!

Well then, it was Conspi PR!

The person who wrote this blog

conspirit public relations

We disseminate information both internally and externally to improve our company's awareness and brand power. We conduct promotional activities by clarifying reach methods based on market, competitor, and company research and analysis.