Continuation from last time "Invoice systemI would like to introduce you to ``.

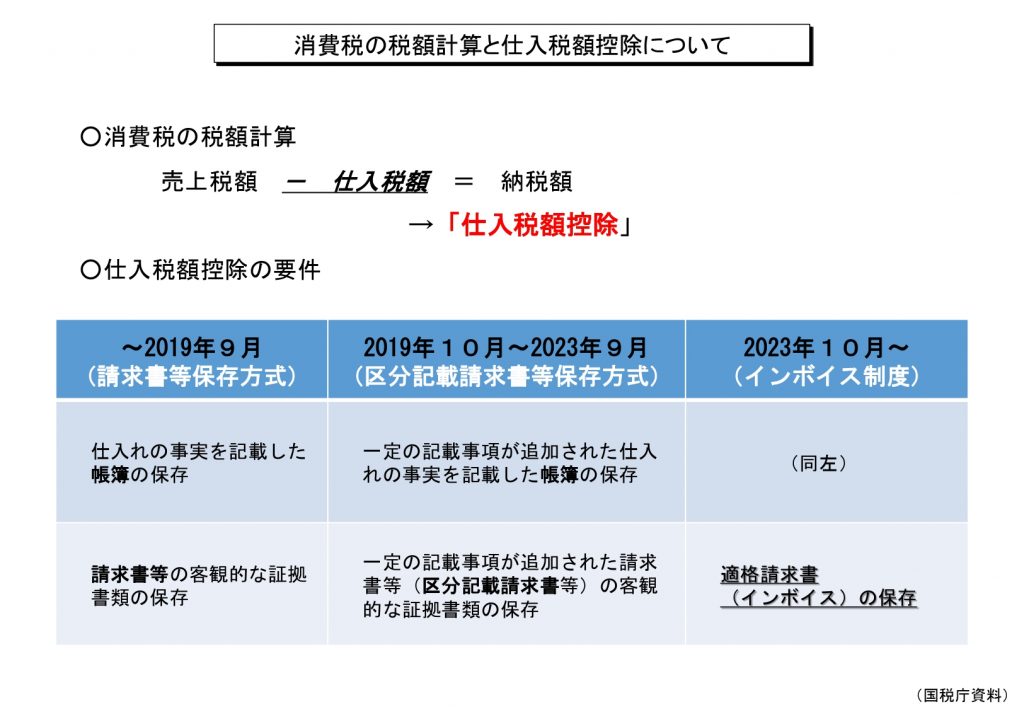

The consumption tax rate has been raised to 10%, and we are now accustomed to both 8% and 10% consumption tax rates being applied, but the invoice system is a new system related to this consumption tax reform. In this article, we will explain the outline of the invoice system and the specific steps to take in response to the new system.

There may be various procedures that need to be completed, so we recommend that you start preparing as early as possible.

Contents of eligible invoices

Once the invoice system is introduced, businesses will need to issue and keep qualified invoices that meet the requirements set out by the system.In principle, input tax credit is not available..

Therefore, if a qualified invoice is not issued for purchases, you will end up having to pay more consumption tax than you should have paid.

Not everyone can issue qualified invoices. It is important to fully understand which businesses are eligible to issue them and what is included in a qualified invoice.

Businesses that can issue qualified invoices

Businesses that can issue qualified invoices are those that have been registered by the tax office director as qualified invoice issuers.

In order to be recognized as a qualified invoice issuing business, in addition to applying for registration, you must become a taxable business for consumption tax. If you were previously a tax-exempt business, you will become a taxable business from the day you are registered as an issuing business, and will have to declare and pay consumption tax.

Registration applications will be accepted from October 1, 2021It has already begun. In order to become a registered business on October 1, 2023, when the invoice system will be introduced,In principle, registration applications must be submitted by March 31, 2023.there is.

To apply for registration, you must submit the required form to the tax office,e-TaxIt can also be done online using.

Details of qualified invoice

A qualified invoice is a document created as a means of conveying the correct consumption tax rate or amount.There are no restrictions on the name or format of documents, such as invoices, delivery notes, receipts, etc..

The information to be included is as follows:

① Name or title of the qualified invoice issuer and registration number

② Transaction date

③ Transaction details (item subject to reduced tax rate)

④ The total amount of consideration divided by tax rate (excluding or including tax) and the applicable tax rate

⑤ Consumption tax amount, etc. (fractionalization is done once for each tax rate per invoice)

⑥ Name of the business entity receiving the document ※Extracted from National Tax Agency materials

Businesses that serve an unspecified number of consumers as customers, such as retail stores, restaurants and izakayas, and taxi operators,⑥ Simplified qualified invoices can be issued, for example by omitting the name or business name of the business receiving the documents..

In addition, there are exceptions to the rule that allow input tax credit to be applied even if the issuance of a qualified invoice is exempt or if a qualified invoice is not received or retained. For details, please see the National Tax Agency website.

Overview of the invoice system (National Tax Agency website)

https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/invoice_about.htm

For retailers that have introduced POS registers, new measures are often not necessary because the current system covers most of the information required except for the business registration number. However, for general companies that issue invoices, measures such as changing the invoice format will be necessary.

next time"Invoice system: Impact on tax-exempt businessesI would like to introduce you to ``.

At Conspirito, we have a wealth of content on our website that you can learn from the perspective of a real estate management company.

The person who wrote this blog

Conspirit Blog Writer

Conspirito's official blog writer will deliver useful information about real estate.