Learn real estate management

Comparison with other financial products

Q: Aren’t bank deposits less risky?

A: Of course, highly liquid cash assets are very important. However, that is a completely different issue from whether or not there is risk.

For example, in April 2005, the ban was lifted.Payoff systemFor one thing, the maximum amount of deposits that can be protected is 10 million yen plus interest. If a financial institution goes bankrupt and a payoff is implemented, any amount above the limit will not be protected. (Note: "Settlement deposits" that do not earn interest are fully protected.)

Also, as is often mentioned, cash assets are vulnerable to rising prices, and in principle there is no way to deal with a relative decline in the monetary value of the cash you hold.

However, rather than blindly believing that "real estate is better," it is important to re-examine the strengths and weaknesses of each financial product and financial asset and hold them in an appropriate manner.

For information on the strengths and weaknesses of real estate, please refer to the next section, "Dividing assets into three parts."

Q: I've heard of the "triangulation of assets"... what is it?

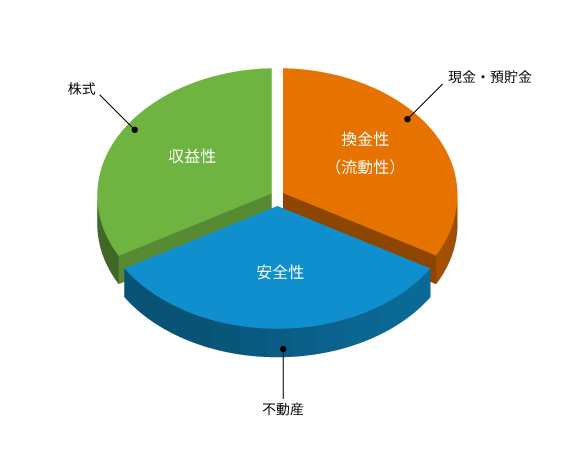

A: When evaluating asset investment products and financial products"Safety," "liquidity," and "profitability"It is said that assets should be evaluated using these three scales, but the asset trichotomy aims to diversify risk by combining financial products with these different scales (= portfolio theory).

We have given representative examples of investments according to their respective characteristics, but these are by no means limiting.

When it comes to real estate (land) specifically, while it has advantages such as being resistant to inflation and its asset value never falling to zero, it also has a weakness in that it is difficult to convert into cash.

It is important to fully understand the characteristics of each and then decide how much to allocate to each.

Seminar/Webinar

At Conspirit, we hold seminars and webinars as [learning content] in order to bridge the "information gap" between customers and real estate companies. Please experience the [learning content] provided by a management company that is a professional in operation and asset value maintenance.

free real estate

Individual counseling

We accept all inquiries regarding rental management, sales appraisals, and real estate. After applying, we will contact you.

Regarding real estate management and real estate investment

For inquiries, please click here